Weekly Market Update (20/3/17 - 24/3/17)

- campazine

- Mar 27, 2017

- 3 min read

The market decided to paint last week in red.

SP500 Weekly Performance: -1.44%

Investors who have gotten accustomed to a steady string of gains in the stock market were taken aback by this week's action, which sent the S&P 500 lower by 1.4%. This marked the fourth weekly decline of 2017 and was the largest weekly drop since early November.

The week got off to an unassuming start as Monday's action was confined to a narrow range. There was no noteworthy earnings or economic news to digest, and the impending House vote on the plan to repeal and replace the Affordable Care Act led to caution among participants.

That caution turned into outright selling on Tuesday, sending the S&P 500 lower by 1.2%. A number of factors were cited for the decline, but the day's selling was most aggressive in the financial sector as the SPDR S&P Bank ETF (KBE) fell 4.8%. The industry group stumbled as the yield curve continued flattening in a manner that contradicts the pro-growth narrative that accompanied the stock market on its charge to a fresh record.

Furthermore, the prospect of health care reform making its way through the legislative process dimmed as the week went on. The House of Representatives was scheduled to take part in a Thursday vote, but that vote got put on hold and cancelled on Friday afternoon due to a lack of support. Investors are acutely aware that a delay in passing health care reform means that tax reform will also need to wait.

Although the week was quiet on the economic front, it is worth noting that February Existing Home Sales (5.48 million; Briefing.com consensus 5.54 million) missed estimates while February New Home Sales (592K; Briefing.com consensus 560K) and February Durable Orders (+1.7%; Briefing.com consensus 1.3%) were better than expected. The Durable Orders report caused the Atlanta Fed to nudge its GDPNowcast for the first quarter up to 1.0% from 0.9%. To be fair, excluding transportation, Durable Orders (+0.4%; Briefing.com consensus 0.7%) came up shy of estimates, indicating relatively weak business spending.

Taking a look at rate hike expectations, the fed funds futures market spent the week pointing to a 50.0%+ likelihood of a June hike, but that implied probability dropped to 49.6% on Friday afternoon after the news of the health care vote being pulled made the rounds. One week ago, the fed funds futures market showed a 58.3% implied probability of a hike in June.

Nasdaq Composite +8.3% YTD

S&P 500 +4.7% YTD

Dow Jones Industrial Average +4.2% YTD

Russell 2000 -0.2% YTD

(Extracted from www.briefing.com)

Sector performance:

The week sees all sectors ended in the red except Real Estate and Utilities, with Financials slashing the most gains.

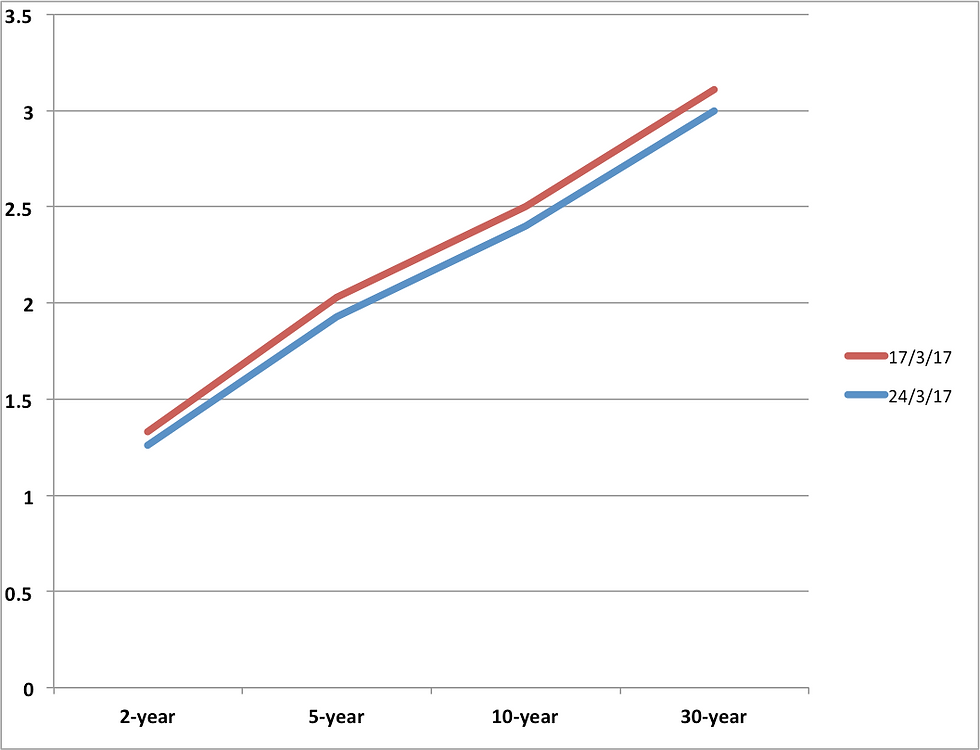

Yield performance:

The yield curve flattened from a week ago, indicating risk-off mode and flight to safety.

Commodities performance:

Crude oil closed lower.

Gold closed higher.

Silver closed higher.

Copper closed lower.

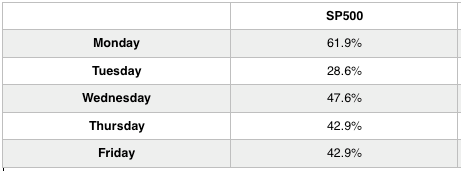

Coming Week 13 BMO:

During the last 5 years, Week 13 sees a 80% chance of positive returns at 0.51%.

For the last 20 years, Week 13 sees at least a 70% chance of positive returns.

Info: Stock Trader's Almanac

March historically weak later in the month.

Rather turbulent in recent years with wild fluctuations and large gains/losses.

Last trading day, Dow down 17 of last 27. Russell 2000 up 16 of last 23.

Important Earnings Release: None

Key Economic Dates:

Mon:

German Ifo Business Climate

Tues:

CB Consumer Confidence

Wed:

Pending Home Sales, Crude Oil Inventories

Thurs:

Final GDP, Unemployment Claims

Fri:

Core PCE Price Index, Revised UoM Consumer Sentiment, Personal Spending, Chicago PMI, China Manufacturing & Non-Manufacturing Index

Thoughts:

When the stock trader's almanac and seasonal model for coming week have extreme results, I'd expect more uncertainties ahead-- a valid reason to stay cautious. Although historically last 5 years have seen a very high chance of positive returns, I doubt that this year it would be the same as investors have become suspicious on how President Trump is able to execute his plans that Wall Street has cheered on since his victory following the failure of health care reform on Friday. The market lacks steam to keep going as the biggest catalyst disappointed, the OPEC meeting on Sunday also did not help. Having said that, I'd expect that this week to be a rather down and also a volatile week due to window dressing, except if there's news that could inject positivity into the market sentiment.

Comments