Weekly Market Update (27/3/17 - 31/3/17)

- campazine

- Apr 3, 2017

- 3 min read

Coming week's focus: Trump-Xi Meeting. Handshake or Market-shake?

SP 500: 0.8%

After falling 1.4% last week, the S&P 500 rebounded, rising 0.8% for the week. The benchmark index wrapped up a solid first quarter (+5.5%), which was overshadowed by an even better performance from the Nasdaq, which gained 1.4% for the week, extending its first quarter gain to 9.8%.

There's no question that the GOP's failure to compromise on health care reform last Friday left an impression on this week's activities, maybe most notably on Monday. Investors kicked off the week cautiously as it remains largely unclear how the failure to bring the American Health Care Act to a vote will impact the widely-anticipated tax reform legislation.

In addition, investors are also starting to question the new administration's ability to find middle ground with some of the more conservative Republicans in Congress. This issue will certainly manifest itself in the debate on tax reform as the party remains divided on the need to include a border adjustment tax in the overall fiscal overhaul.

Despite the looming uncertainty, the S&P 500 bounced off its 50-day moving average on Tuesday to post its best performance of the week. House Speaker Paul Ryan and Majority Leader Kevin McCarthy stoked the fire by leaving the door open to revisiting health care reform. This was contrary to earlier remarks from President Donald Trump, who vowed to move to tax reform without looking back. For investors, if the GOP can cut health care costs, the savings could support a larger tax break.

Crude oil took center stage in the middle of the week following a bullish inventory report from the EIA and rumors that the OPEC/non-OPEC production cut may be extended beyond June. The energy component went on a three-day rally while the energy sector helped the stock market finish slightly higher on Wednesday and Thursday.

Equities closed out the week, and the quarter, with a flat showing on Friday that kept the S&P 500 inside an eight-point range.

A week of mostly hawkish talk from Federal Reserve officials brought rate hike expectations back to levels from two weeks ago. The implied probability of a rate hike in June climbed to 62.5% from last week's 49.6%, according to the fed funds futures market.

Nasdaq Composite +9.8% YTD

S&P 500 +5.5% YTD

Dow Jones Industrial Average +4.6% YTD

Russell 2000 +2.1% YTD

(Extracted from briefing.com)

Sector Performance:

The aggressive sectors lead the week while defensive sectors lag behind.

Yield Performance:

The yield remains unchanged for the week, indicating non-change of decreased risk-appetite from previous week.

Commodities Performance:

Crude oil closed higher.

Gold closed lower.

Silver closed higher.

Copper closed higher.

Coming Week 14 BMO

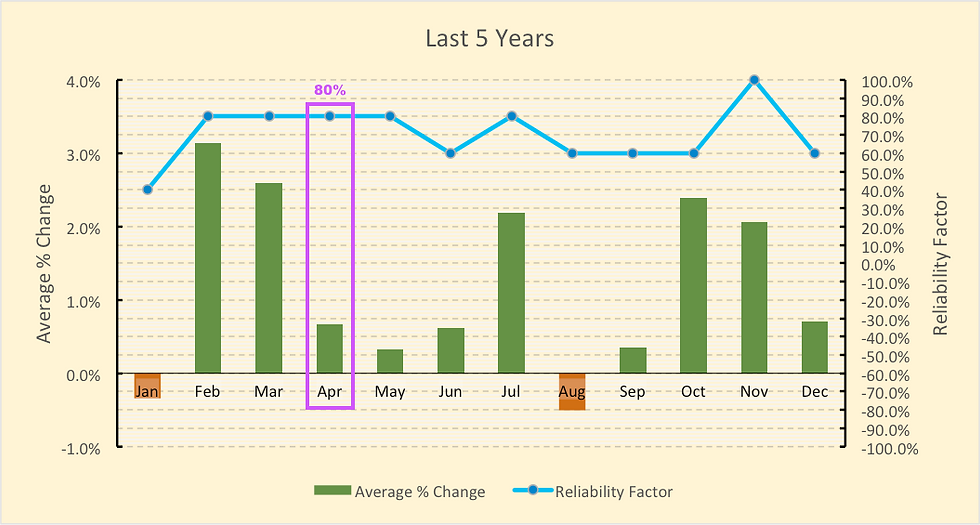

Although April is considered as one of the best months of the year, the start of the month normally has weak returns historically according to the seasonal model.

Info: Stock Trader's Almanac

April is the 3rd best month for SP500, 4th best for NASDAQ since 1971

Up 10 straight, average gain 2.6%

Prone to weakness after mid-month tax deadline.

Stocks anticipate great Q1 earnings by rising before earnings are reported, rather than after

Rarely a dangerous month, recent exceptions are 2002, 2004, 2005

Post-presidential election year Aprils solid since 1950.

End of April NASDAQ strength.

First trading day in April, Dow up 17 of last 22.

Important Earnings Release: MON, WBA, STZ

Key Economic Dates:

Thoughts:

Last week did not turn out as expected to be a down week, the SP500 recorded a 0.8% gain instead. The window dressing rallied the market as usual and the market has not really feared about the failure of health care reform, probably because the Republicans are leaving the chance to revisit the reform opened. The coming week has two very important factors that could rock the market, which is the Trump-Xi meeting on Thursday and the release of non-farm employment report. The meeting between two economic giants could provide the catalyst that the market is waiting for, the unknown is whether it could boost it or not as the trade war policy is expected to be the main focus of the 'picnic'. The first two days of the week might see some gains as the optimism that normally occurs in April. However, note that the market ended last Friday in red, so would it be a down Monday if it's said that Monday normally resumes the performance in Friday? Judging based on the early Asian markets performance today and the signals from the commodities and bond yield, I reckon it will not be a down Monday later when the market opens. But still, things might turn south.

Comments