AMC Weekly Market Update: 3/4/17 - 7/4/17

- campazine

- Apr 8, 2017

- 3 min read

President Trump is the God of Handshake. Every time he shakes my heart drops.

He seems to be quite a dominating person who aims to take absolute control.

SP 500: -0.3%

The stock market saw limited movement during the past week, leaving the S&P 500 just below its closing level from last Friday. The benchmark index bounced around a 34-point range before locking in a modest weekly loss (-0.3%) while the Dow Jones Industrial Average (unch) outperformed.

Geopolitical developments were in focus from the jump. On Monday, President Donald Trump was quoted as saying he is ready to act alone on North Korea if China does not change the current situation on the Korean peninsula. The comments were made just days before Chinese President Xi Jinping's visit to President Trump's resort in Florida and ahead of a joint military exercise held by South Korea, the United States, and Japan. North Korea was back in the headlines on Wednesday when it conducted another missile test.

The geopolitical conversation did not end there. On Friday morning, participants learned that the U.S. Navy conducted an overnight strike against the Shayrat airbase in Syria, which was deemed responsible for a chemical attack that was reportedly conducted on Tuesday. The action was supported by several U.S. partners while Russia suspended its information sharing agreement with the U.S. that was put into effect when Russia launched an air campaign in Syria in 2015.

In addition to the geopolitical developments, participants received the latest Employment Situation report, which was a disappointment. Only 98,000 nonfarm payrolls were added in March, which was a far cry from the Briefing.com consensus estimate of 180,000. Average hourly earnings increased 0.2% (Briefing.com consensus 0.3%) and February earnings growth was revised up to 0.3% from 0.2%.

The report spoke to the ongoing disconnect between the hard data and the soft data and it should challenge the stock market's economic growth assumptions. The growth assumptions may also be put to a test by policy actions from the Federal Reserve, considering the FOMC Minutes that were released on Wednesday revealed a discussion about a reduction to the Fed's balance sheet in the near term.

As for rate hike expectations, the fed funds futures market does not expect a rate hike to be announced in May (4.3%), but expectations for a June hike have firmed a little, with the corresponding probability rising to 70.6% from last week's 62.5%.

Nasdaq Composite +9.2% YTD

S&P 500 +5.2% YTD

Dow Jones Industrial Average +4.5% YTD

Russell 2000 +0.5% YTD

(Extracted from www.briefing.com)

Sector Performance:

Aggressive sectors like Discretionary, Financials, Technology slipped to the negative from last week.

Health Care, Industrials, Materials barely have any significant moves, while Real Estate and Energy continue their gains from last week.

Utilities is the only sector that has improved from the negative zone last week.

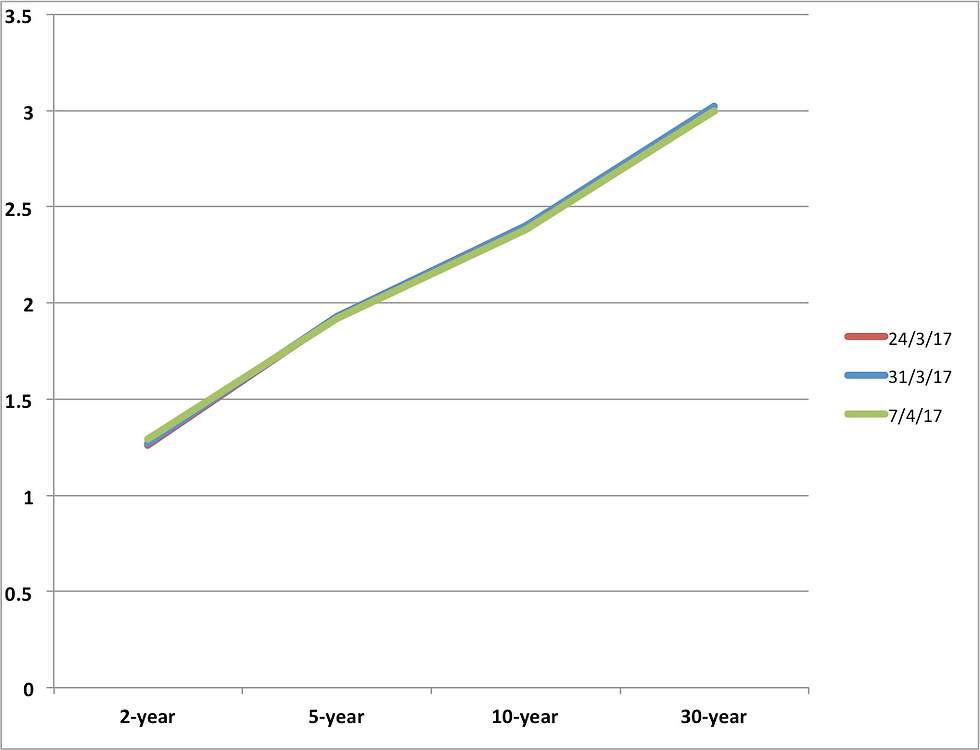

Yield Performance:

The yield curve has barely moved. However, one thing we should stay cautious is that the chance of the curve to go 'inverted' has become higher as compared to last week as the yields for shorter-term treasuries have gone up while longer-term treasuries' yields have gone down, signalling the investors' 'flight-to-safety' thought has actually gone up and have become increasingly not confident in the long-term growth of the economy.

Commodities Performance:

Crude oil closed higher.

Gold closed higher.

Silver closed lower.

Copper unchanged.

Coming Week 15 BMO:

Just as last week, week 15 has little to cheer about according to the seasonal model.

Info: Stock Trader's Almanac

NASDAQ up 16 straight days before Good Friday

Market closed on Friday

Important Earnings Release:

Wed: DAL

Thurs: C, JPM, WFC

Key Economics Date:

Thoughts:

As expected, the SP500 wasn't performing well last week. The worse-than-expected job report, Trump's missiles launched as response to Syria's chemical attack, North Korea's missiles test, and Trump-Xi Summit have caused the market to be largely range-bound throughout the week as investors have a wait-and-see attitude. It's no doubt that these issues happened have made the investors to be extra cautious because the increasing political risk and the meeting between 2 economic giants have big potential to roil the market.

As there's one more week to tax deadlines, I'd expect the market to resume this kind of movement and only has significant change during the last 2 weeks of April, which is typically a bullish one towards the end. But who knows? We still haven't gotten any meaningful news on the Trump-Xi meeting yet. While waiting for the fog to clear, there's something that excites me in the coming week-- the earnings release of several volatile stocks to kickstart the earning season. The world is keeping an eye on this sector to get any clues on how well the economy may go.

Comments