Weekly Market Update (24/4/17 - 28/4/17)

- campazine

- May 2, 2017

- 3 min read

Marine Le Pen: Hahaha I'm in!

SP500: 1.51%

The French people narrowed their presidential race to two candidates last Sunday--Emmanuel Macron and Marine Le Pen--with the results fueling a buying frenzy around the world on Monday. According to the most recent polls, Mr. Macron, who is a proponent of tighter EU integration, has a comfortable advantage over Ms. Le Pen, who would like to conduct a French referendum on eurozone membership, leading investors to believe the EU has dodged the latest populist bullet. The run-off will be conducted on Sunday, May 7.

Buyers took center stage again on Tuesday in an encore performance that left the S&P 500 higher by 1.7% after the first two sessions of the week. The positive sentiment surrounding the French vote lingered, but earnings were the focal point with Dow components Caterpillar (CAT), McDonald's (MCD), and DuPont (DD) feeding the bulls with better than expected top and bottom lines.

However, the stock market hit a speed bump on Wednesday amid the unveiling of President Trump's tax outline. The general framework of the plan was encouraging to investors, but specific details, like how it will be paid for, were in short supply. Without any offsetting sources of revenue, the tax cuts will add to the budget deficit, which will be a difficult pill for some conservative lawmakers to swallow.

Range-bound action continued throughout the remainder of the week as investors responded to upbeat earnings reports with caution, hesitant to extend the stock market's already solid 2017 gain amid disappointing first quarter GDP growth (+0.7%; Briefing.com consensus 1.1%). In addition, continued geopolitical tension related to North Korea weighed on investor sentiment.

In the end, the stock market's early-week rally more than made up for the second-half slump, leaving the S&P 500 with a weekly gain of 1.5%. The upbeat sentiment also led to an increase in rate-hike expectations. The fed funds futures market points to the June FOMC meeting as the most likely time for the next rate-hike announcement with an implied probability of 66.6%, up from last week's 48.5%.

Nasdaq Composite +12.3% YTD

S&P 500 +6.5% YTD

Dow Jones Industrial Average +6.0% YTD

Russell 2000 +3.2% YTD

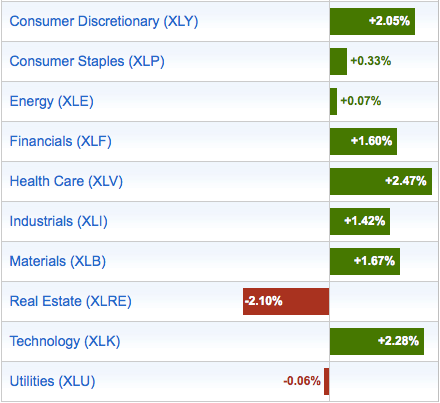

Sector Performance:

Utilities and Real Estate did not manage to continue their upbeats from last few weeks, but Utilities finished the week in just a little red. As last week, all aggressive sectors have fared well.

Yield Performance:

The yield curve has steepened, indicating increased risk appetite in the market. The investors could have felt good about the good earnings reported despite Q1 GDP miss.

Commodities Performance:

Crude oil closed lower.

Gold closed lower.

Silver closed lower.

Copper closed higher.

May BMO:

From historical data over the last 5 years, May has 80% chance of ending the month in bull's territory, but with low return. The most gains often registered during the final week (Week 21) of May and the most bearish week is Week 20.

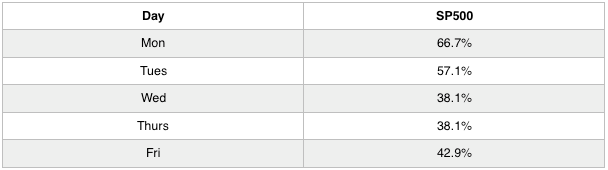

Over the last 5 years, Week 18 only has 40% chance of ending the week in green. This even holds true over the last 25 years as Week 18 has low chance of recording a bull's victory.

Info: Stock Trader's Almanac

First trading day in May, Dow up 14 of last 19

Worst 6 months of the year begin with May

Dow Memorial Day week record: up 12 years in a row (1984 - 1995), down 12 of the last 20 years

Since 1950, post-presidential election year Mays rank well

Important Earnings Release:

Tues BMO: MO, HLT, MA, MRK, MOS, PFE

Tues AMC: AAPL, ETSY, MDLZ

Wed BMO: CLX, RAI, TWX, YUM

Wed AMC: FB, TSLA

Thurs BMO: H, K

Thurs AMC: HLF

Key Economic Dates:

Thoughts:

May has been seen as one of the scariest month of the year. Although the Q1 GDP proved to be disappointing, the better-than-expected earnings have kept the bears at bay and fuelling the market's increasing optimism, even as Trump's most anticipated tax reform does not yield any meaningful new info or confirmation yet. The highlights of GDP include:

Consumer spending dropped for durable & non-durable goods and also services.

Drop in private inventories

Fixed investment increased.

Exports increased more than imports.

Ironically, the optimism came as weaker data and deep concern being constantly reported, which could suggest the market could have reached the euphoria state. Nevertheless, will this May lead to a sell-off? Judging from the yield curve, perhaps not yet. But I'm ready to construct a vertical spread to take advantage of the Week 18's weak returns into Week 20.

Comments