Weekly Market Update (1/5/17 - 5/5/17)

- campazine

- May 8, 2017

- 3 min read

The bull is having party, don't wake it up.

SP500: 0.63%

The S&P 500 opened the week by eking out back-to-back wins. Monday's marginal victory was fueled by the top-weighted technology and financials sectors while Tuesday's uptick took place despite the lack of sector leadership and crude oil's 2.5% decline. On the political front, Congress reached an agreement to keep the government funded through September while President Trump reiterated that he might like to break up the nation's biggest banks.

On Wednesday, the benchmark index registered its first, and only, loss of the week (-0.1%) after Apple (AAPL) reported lower than expected iPhone unit sales. However, the tech giant's upbeat earnings kept losses in check. The FOMC voted to leave the fed funds target range unchanged at 0.75%-1.00%, as expected, with the accompanying policy statement providing little to no new information.

The House of Representatives passed the revised American Health Care Act on Thursday, a big victory for the GOP. However, the bill will face heavy resistance in the Senate, where it can only afford to lose two Republican votes. Crude oil also made headlines, plunging 4.7% to a five-month low near $45.50/bbl. The tumble was credited to a string of disappointing inventory reports, some weak data out of China, and the deteriorating technical picture for the commodity. The S&P 500 added 0.1%.

Buyers were intrigued by Friday's better than expected Employment Situation Report for April, however, gains were capped once again ahead of the final round of the French presidential election, which will take place on Sunday. Polls suggest that Emmanuel Macron will easily defeat his rival Marine Le Pen, which has been construed as a positive for global equity markets given Ms. Le Pen's anti-EU rhetoric. France's CAC ended the week at its highest level in over ten years.

In the end, despite the range-bound action, this week will be remembered as a happy one with the S&P 500 advancing for the fourth week in a row, adding 0.6%. The fed funds futures market still points to the June FOMC meeting as the most likely time for the next rate-hike announcement with an implied probability of 83.1%, up from last week's 66.6%.

Nasdaq Composite +13.3% YTD

S&P 500 +7.2% YTD

Dow Jones Industrial Average +6.3% YTD

Russell 2000 +2.9% YTD

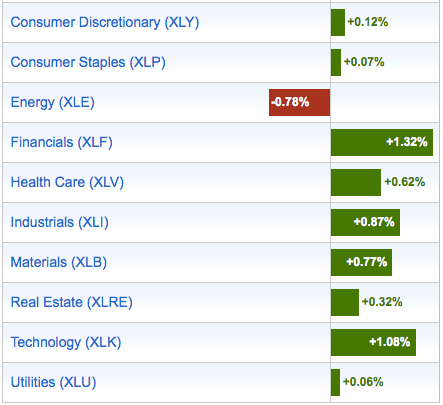

Sector Performance:

All aggressive sectors continue to perform well, except energy, utilities, and staples that lag behind. Discretionary sector has slowed down significantly.

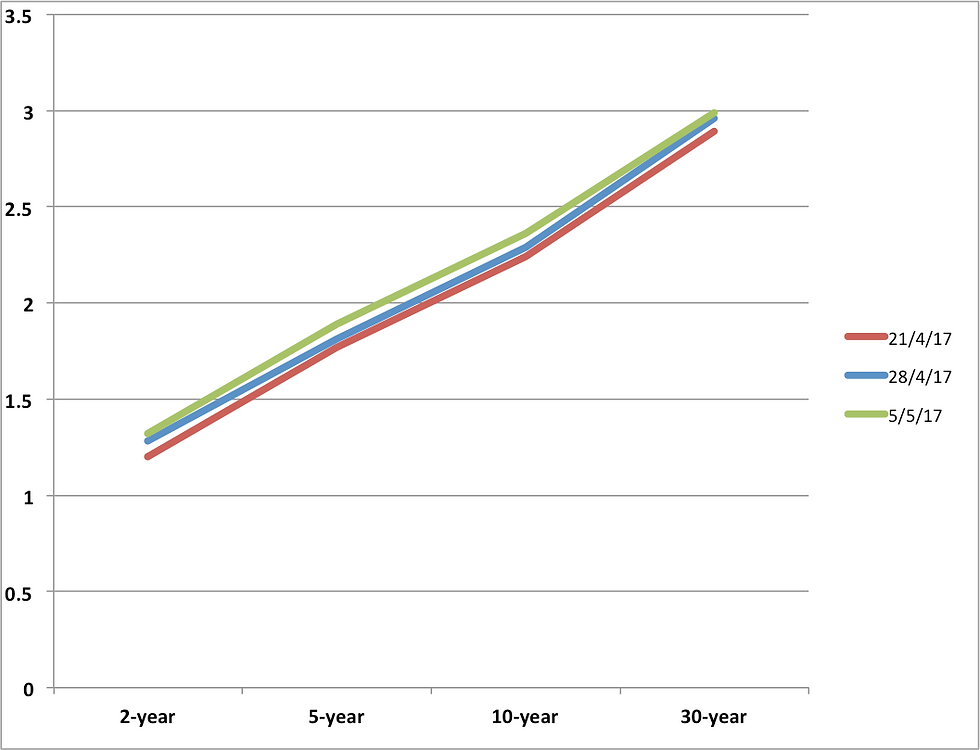

Yield Performance:

The market has increasing appetite in the stock market from last week as the yield curve steepened.

Commodities Performance:

Crude oil closed lower.

Gold closed lower.

Silver closed lower.

Copper closed lower.

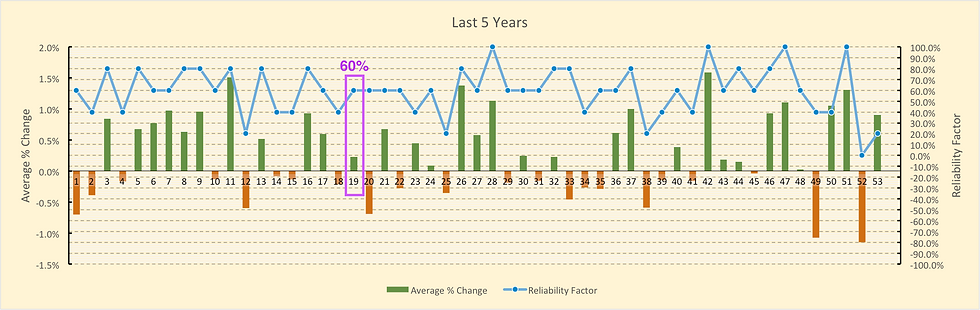

Week 19 BMO:

Even as over last 25 years, Week 18 has recorded low reliability of bullish moves, last week proved to be wrong. But that's not to say there're nothing cheerful happened:

Oil traded higher after a big drop on Friday;

Strong April job data

House finally approved revised American Health Care Act-- a sign of confidence vote on Trump.

A big chunk of the week's gain actually recorded on Friday because of the lowest unemployment rate since 2007 and oil finally reversed its direction. Week 19 has 60% reliability to end the week in positive gains.

Info: Stock Trader's Almanac

Friday before Mother's Day, Dow up 15 of last 22.

Important Earnings Release:

Mon BMO: TSN

Mon AMC: MTW, MAR

Tues BMO: JEC, AGN

Tues AMC: PCLN, DIS

Wed AMC: FOXA, WFM

Thurs BMO: KSS, M

Thurs AMC: JWN

Fri BMO: JCP

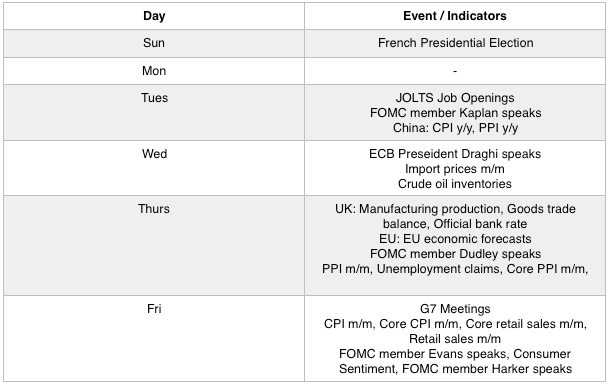

Key Economic Dates:

Thoughts:

Last week seemed to be quite a range-bound movement but it ended the week with 0.63% gain, which was largely because the investors were pricing in the probability of Macron's presidential win, good job report, and rebound in oil. Although we now have the lowest unemployment rate at 4.4% since May 2007, but I've become even more cautious because:

the labor force participation rate dropped to 62.9% from 63%

the number of long-term unemployed was unchanged

the market went into a downtrend after 4-6 months later in 2007 after a full employment rate was recorded, and what happened next is history

As of the time of my writing, Macron has won the presidential election as Le Pen has conceded defeat. The market could open Monday with bulls. Thus, I would not be surprised if the coming week records a win again together with the support of the seasonal model that suggests a 60% reliability. This May seems to be quite a good month, is it because of the post-presidential election year that May always ended well? Or is it because of the conspiracy that during odd years May would go up while it'd be down during even years? Whatever it is, both yield curve and gold have showed increased risk appetite, aggressive sectors have performed well, why would you think that the market isn't going to do well later?

Mark Twain: "Whenever you find yourself on the side of the majority, it is time to pause and reflect."

Comments