Weekly Market Update: 8/5/17 - 12/5/17

- campazine

- May 15, 2017

- 4 min read

Who's still shopping at the offline stores?!

SPY: -0.36%

After posting gains for four weeks in a row, the S&P 500 suffered a slight setback this week, ticking lower by 0.4%. However, the Nasdaq enjoyed a small victory, adding 0.3%, as it continued to ride the relative strength of Apple (AAPL), Amazon.com (AMZN), and a gaggle of semiconductor issues led by NVIDIA (NVDA).

The S&P 500 was flat through the first three sessions of the week with a slim loss on Tuesday wiping out small victories on Monday and Wednesday. The range-bound performances followed Sunday's French presidential election in which centrist candidate Emmanuel Macron handily defeated far-right candidate Marine Le Pen, as expected. Mr. Macron's victory was seen as a positive for global equity markets as it takes the possibility of France leaving the European Union off the table for the foreseeable future.

With a key risk event averted, the CBOE Volatility Index (VIX) retreated to a historically-low level. The VIX, also known as the "investor fear gauge", settled Monday at its lowest mark since December 1993 and finished Tuesday and Wednesday below 10.00. Prior to this week, the VIX had only settled below the 10.00 mark nine times.

Crude oil became a focal point on Wednesday after the Energy Information Administration reported the largest weekly decline in U.S. crude stocks so far this year. The bullish reading prompted a two-day rally for the commodity, and the energy sector, which ultimately left WTI crude with a weekly gain of 3.5%.

Also of note, President Trump unexpectedly fired FBI Director James Comey on Wednesday. That move triggered a tidal wave of political opinions and raised some concerns about the path of progress for the Trump Administration's pro-growth plans that stymied the stock market. Overall, though, it did not cause any major selling in the stock market.

Retailers captured investors' attention on Thursday when Macy's (M) plunged 17.0% in reaction to its disappointing earnings report. Kohl's (KSS), Nordstrom (JWN), and J.C. Penney (JCP) also slipped after delivering their quarterly results, leaving the SPDR S&P Retail ETF (XRT) lower by 2.9% for the week. Disappointing Retail Sales for April (+0.4% actual vs +0.6% Briefing.com consensus) didn't help matters, but some of the sting of that headline was taken out by an upward revision for March to 0.1% from -0.3%.

April CPI came in roughly as expected on Friday with total CPI rising 0.2% (Briefing.com consensus 0.2%) and core CPI, which excludes food and energy, adding 0.1% (Briefing.com consensus 0.2%). On a year-over-year basis, total CPI is up 2.2% and core CPI has increased 1.9%. Following the data, Chicago Fed President Evans said that he expects one or two additional rate hikes this year with the actual number depending on the level of inflation.

The fed funds futures market still points to the June FOMC meeting as the most likely time for the next rate-hike announcement with an implied probability of 78.5%, down from last week's 83.1%. In the Treasury market, increased buying interest in the second half of the of week left the benchmark 10-yr yield at 2.33%, which is two basis points below last Friday's closing level.

The S&P 500 posted modest losses on Thursday and Friday, which is what ultimately tipped the week in the bears' favor.

Nasdaq Composite +13.7% YTD

S&P 500 +6.8% YTD

Dow Jones Industrial Average +5.7% YTD

Russell 2000 +1.9% YTD

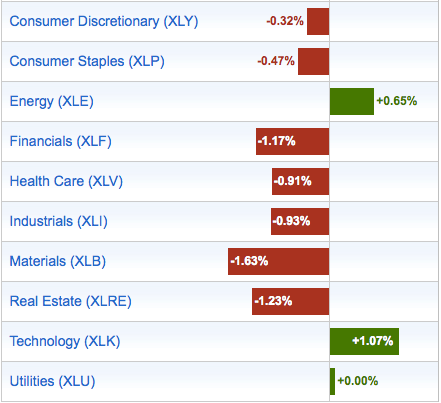

Sector Performance:

All sectors, except Energy, Technology and Utilities ended the week in red. Technology advanced mostly because of upbeat in Apple, Nvidia, and Amazon. Utilities sector is the only sector that has rather consistent positive performance over last few weeks.

Yield Performance:

The market generally bought more bonds than last week as the yields have reduced overall, but more are bought in near-term treasuries, citing doubt in the near-term economy.

Commodities Performance:

Crude oil closed higher.

Gold closed lower.

Silver closed higher.

Copper closed higher.

*Gold, silver, and copper did not have significant move.

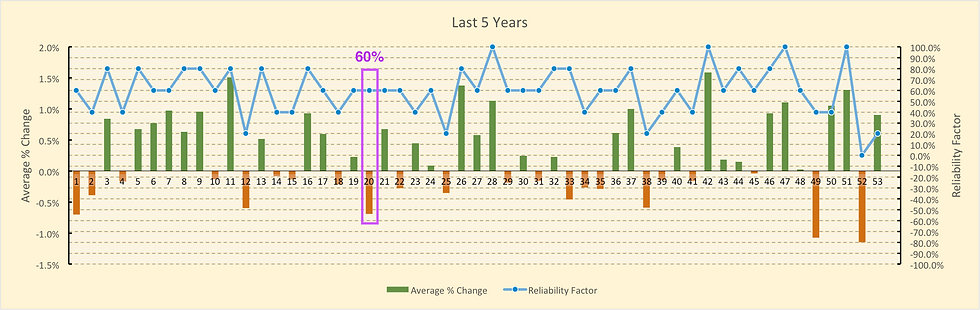

Week 20 BMO:

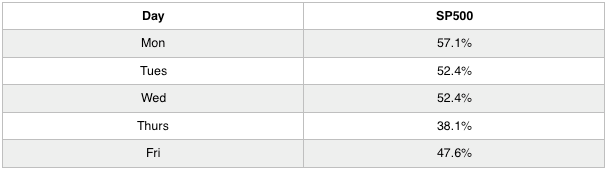

As we can see from the chart above, Week 20 is quite bearish, but only with 40% reliability. If the market sentiment is weak, it'd have high probability that the week will slash quite a significant gains away. Just FYI, last 3 years Week 20 ended in green. Nevertheless, the Almanac below has shown a rather bearish probability in the coming week even as the seasonal model above painted a rather rosy picture, especially on Thursday.

Info: Stock Trader's Almanac

Monday after Mother's Day, Dow up 15 of last 22.

Monday before May expiration, Dow up 22 of last 29, average gain 0.4%.

Important Earnings Release:

Tues BMO: TJX, HD

Tues AMC: URBN

Wed BMO: AEO, TGT

Wed AMC: CSCO, LB

Thurs BMO: RL, WMT

Thurs AMC: GPS, ROST, CRM

Fri BMO: CPB

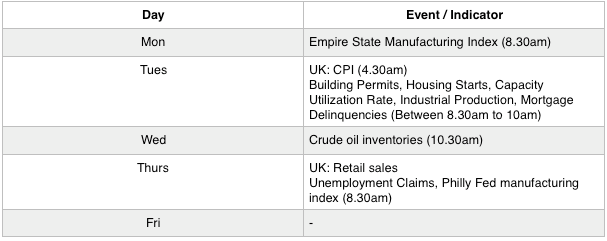

Key Economic Dates:

Thoughts:

Again, the market did not end well by slashing a small amount of gains off the market, except NASDAQ. The news about Apple being the first company to top USD800BIL are all over the sites. Even giants like Amazon and Apple did exceptionally well over the last week, and as the 1st and 4th largest holdings of SPY respectively, SPY still did not manage to end the week in green as shown in the seasonal model, although historically only a tiny gains average of around 0.3% were supposed to occur. Instead, SPY dropped 0.36% as the retail sector has sparked a broad selling that's started with Macy's disappointing earnings, and then rather weak retail sales data of April. This shows that the consumers aren't spending as much. It looks like retail sector is going to have another round of tough week ahead, as there'll be a couple more of brick-and-mortar retail stores that are going to report their earnings next week, which I expect to be not good.

Besides, Trump's sudden firing of FBI Director James Comey also helped to fuel some concerns among the market. North Korea (again) has launched another missile test on Saturday, creating political instability. All these coupled with the yield curve performance, I'd expect the coming week to be bearish.

Comments