Weekly Market Update (29/5/17-2/6/17)

- campazine

- Jun 5, 2017

- 4 min read

The job report disappoints! Wuwuwu

SP500: 0.96%

The stock market got off to a sluggish start this week as investors begrudgingly returned to their trading desks following the extended Memorial Day weekend. However, things picked up in the second half of the week as employment data for the month of May came into focus. The S&P 500 ended the week higher by 1.0%.

Equities ticked down on Tuesday and Wednesday, breaking the S&P 500's seven-session winning streak, as the energy and financials sectors weighed on the broader market. Crude oil influenced the energy sector lower following reports of heightened production in Libya while cautious comments about second quarter results from major players negatively impacted the heavily-weighted financial group.

Things turned around on Thursday after the ADP National Employment Report for May soundly beat expectations. The S&P 500 hit some technical resistance at its then all-time high, but a bullish EIA inventory report and solid leadership from the financials, consumer discretionary, and health care sectors helped the benchmark index, and its peers, advance to new record highs.

The positive momentum carried into pre-market action on Friday, but a disappointing Employment Situation Report for May forced investors to hit pause. Specifically, nonfarm payrolls (138,000 actual vs 185,000 consensus), nonfarm private payrolls (147,000 actual vs 172,000 consensus), and average hourly earnings (0.2% actual vs 0.3% consensus) all missed expectations.

However, in the grand scheme of things, the jobs report wasn't all that bad; nonfarm payrolls still increased, there was no wage deflation, and the unemployment rate fell to a 16-year low of 4.3%. At the risk of sounding like a broken record, it made for another ‘Goldilocks' report, neither too hot nor too cold, highlighting modest economic growth without amplifying worries of inflation.

Investors took the report in stride, pushing the major averages to new record highs for the second day in a row. The technology sector led the charge, but the energy and financials spaces showed relative weakness, yet again. A flattening of the yield curve weighed on financials while energy moved lower with crude oil following President Trump's decision to pull out of the Paris Climate Accord.

The fed funds futures market still points to the June FOMC meeting as the most likely time for the next rate-hike announcement with an implied probability of 95.8%, up from last week's 83.1%.

Nasdaq Composite +17.1% YTD

S&P 500 +8.9% YTD

Dow Jones Industrial Average +7.3% YTD

Russell 2000 +3.6% YTD

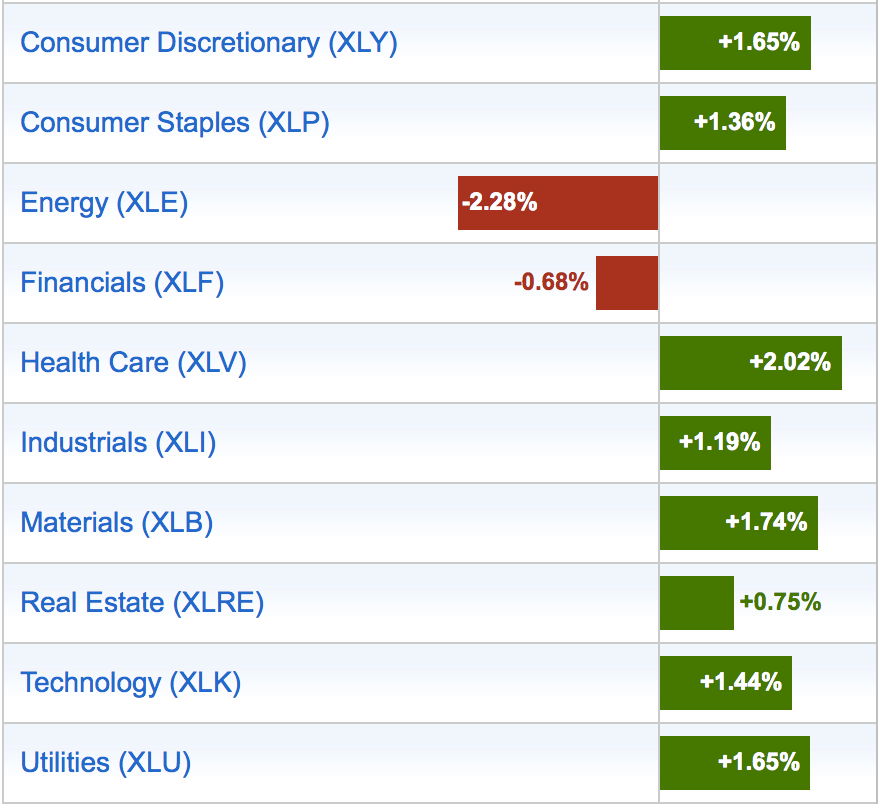

Sector Performance:

All sectors register a gain for the week, except for Energy and Financials. Energy moved lower mainly because of Trump pulled US out of Paris Climate Accord (and Elon Musk's angry about it :( ) and Financials showed weakness because of weaker-than-expected job reports that concern the bond market and the cautious comments from big banks on their Q2 earnings.

Yield Performance:

From the yield curve, we can see that it has flattened considerably from previous week, meaning the bond price has gone up significantly, especially for longer-term bonds, citing a long-term doubt of bond investors in the economy. What is more puzzling is that the bond market rises together with the stock market, as the stock market has had quite a fantastic week by registering almost 1% gain. Comparing the past few weeks' bond market's performance, it shows that there's been increasingly divergent views between bond and stock market investors.

Commodities Performance:

Crude oil closed lower.

Gold closed higher.

Silver closed higher.

Copper closed higher.

Week 23 BMO:

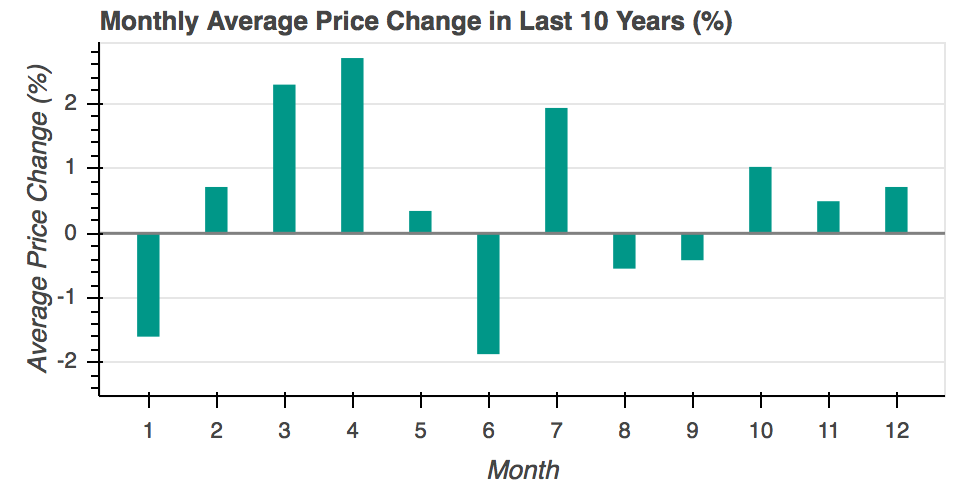

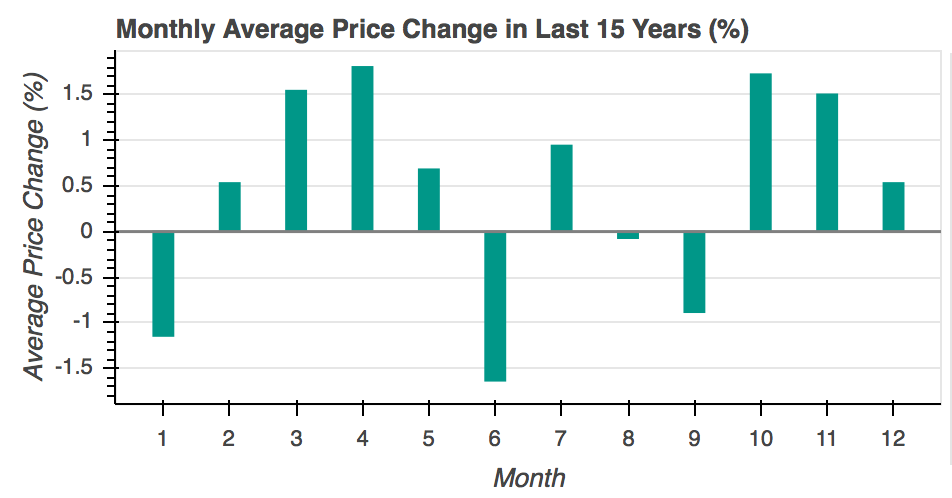

June has been historically weak with rather high reliability factor except for last 5 years. However, it only has 40% reliability factor for a bullish gain in June for the last 5 years. To put it in another words, it has 60% of chance to register negative return for the month as shown in last 15 years.

According to the seasonal scanner, week 23 has shown quite a positive gain with 60% reliability factor, while the middle 2 weeks of June are quite bearish historically.

Info: Stock Trader's Almanac

According to the Stock Trader's Almanac 2017, Week 23 is quite a down week, except for Tuesday, but it was historically an insignificant bullish day.

June ends NASDAQ's best 8 months

2008 second worst June ever, Dow -10.2%, S&P -8.6%

Recent record for June: S&P up 12 down 9, average loss 0.2%

Watch out for end-of-quarter portfolio pumping on last day of June. Dow down 17 of last 25, Nasdaq down 6 of last 11.

As we can see, there is a conflicting result from both seasonal scanner (with data source from yahoo) and the almanac. It's been quite bullish shown in seasonal scanner, but bearish in almanac. As June has been quite a bearish month seasonally with rather high reliability over the last 15 years, the coming Tuesday could be an entry day to enter a bear spread.

Important Earnings Release:

Wed BMO: BFB

Thurs BMO: SJM

Key Economic Dates:

Thoughts:

This week has quite a few big events: the testimony of former FBI director James Comey, UK election on Thursday, ECB press conference, and trade balance for Australia, China, Japan. The market has rallied more than 2% for the past two weeks and is currently at record highs with increasing volumes on both daily and weekly charts, the technicals actually show quite a bullish setup.

Nonetheless, if I marry the technicals with the macros, I'd certainly place much bigger emphasis on the macros. There doesn't seem to be a meaningful catalyst to boost the market significantly higher at the moment, May did not sell off as usual, the bond markets have been showed their concerns, the commodities players are worried. When these happened while the stock market rallied higher, it warns us to stay cautious. I'd attribute most part of the over 2% gain from the stock market to the 'buy-the-dip' mentality from the 1.8% drop on 17/5/17 (so many 'sevens' and it's creepy). Judging from the current state of the market, it seems that any bad news that come out could cause the market to drop easily, and then the market would pick it up again, rally it further, consolidates, then one bad news it tanks again, buy the dip, consolidates, and it goes on and on and on... until one major catalyst comes out-- either fly high or dive deep. Of course, I really expect it to dive deep.

Comments