Weekly Market Update (31/7/17 - 4/8/17)

- campazine

- Aug 7, 2017

- 3 min read

SP500: 0.2%

According to the Dow Jones Industrial Average, the stock market had yet another bullish week; the industrial average ended Friday at a record high, for the eighth session in a row, and a weekly gain of 1.2%. However, the S&P 500 and the Nasdaq tell a less conclusive story; the S&P 500 muscled its way to a modest victory, adding 0.2%, while the Nasdaq dropped 0.4%.

Regardless of this week's mixed performance, there's no question that investors are still bullish as stocks hover near all-time highs and the CBOE Volatility Index (VIX) hovers near an all-time low.

The week's most notable headlines in chronological order:

Crude oil settled July with its best one-month gain (+9.0%) since April 2016

The core PCE Price Index for June hit expectations (+0.1%), as did personal spending (+0.1%), but personal income fell short (0.0% vs 0.3%)

Sprint (S) spiked after beating earnings estimates, raising its profit guidance, and saying it believes an M&A announcement will come "in the near future"

American automakers General Motors (GM) and Ford Motor (F) tumbled following disappointing July sales figures

Apple (AAPL) jumped after beating both top and bottom line estimates and implying that its much-anticipated iPhone 8 release is on track

Treasuries rallied after the Bank of England decided to leave interest rates unchanged in a 6-2 vote

Tesla (TSLA) beat both top and bottom line estimates and announced that its Model 3 production is on track

The Employment Situation Report for July soundly beat estimates, showing the addition of 209,000 nonfarm payrolls (Briefing.com consensus 181,000)

However, average hourly earnings remained subdued, increasing just 0.3% (Briefing.com consensus +0.3%)

Of those headlines, two are worth a closer look--Apple's earnings report and the Employment Situation Report for July. Apple is the S&P 500's largest component by market cap and has played a huge role in the stock market's 2017 advance, evidenced by the massive 29.6% year-to-date gain it took into Tuesday night's earnings release.

Needless to say, it's quite impressive that the company was able to deliver in the face of such lofty expectations. However, it's also important to note that much of the positive sentiment surrounding the company has to do with its upcoming iPhone 8 release, which has been generating hype for months. So far, everything looks to be on track for the fall release, but if that changes, so might the bullish bias.

As for the July jobs report, the key take away is it hit the sweet spot once again as job growth was strong but wage growth was not, keeping inflationary concerns at bay. The fed funds futures market points to the December FOMC meeting as the most likely time for the next rate-hike announcement with an implied probability of 50.4%. Last week, the market expected the next hike to occur in January.

Four sectors settled the week in the green--financials (+1.8%), utilities (+1.5%), industrials (+0.8%), and technology (+0.4%)--while seven groups finished in the red--energy (-1.0%), materials (-0.8%), health care (-0.6%), consumer staples (-0.6%), consumer discretionary (-0.4%), real estate (-0.2%), and telecom services (-0.1%).

Outside of the equity market, the benchmark 10-yr yield slipped three basis points to 2.26%, crude oil dropped 0.5% to $49.44/bbl, and the U.S. Dollar Index climbed 0.3% to 93.35.

Nasdaq Composite +18.0% YTD

S&P 500 +10.6% YTD

Dow Jones Industrial Average +11.8% YTD

Russell 2000 +4.1% YTD

Yield Performance:

The yield curve shifts downwards from previous weeks' curves, not really a risk on attitude, it's potentially indicating more fear.

Sector Performance:

Discretionary, Staples, Healthcare, Materials, Real Estate showing continued weakness from previous weeks.

Financials, Industrials, Technology and Utilities showing strength, Financials being the most impressive, while Utilities and Technology show the most improvements.

Commodities Performance:

Crude oil closed lower.

Gold closed lower.

Silver closed lower.

Copper closed lower.

Week 32 BMO

According to the Stock Trader's Almanac 2017:

The first 9 days of August (first 2 weeks) are historically weak.

August, worst Dow and S&P month 1988-2015

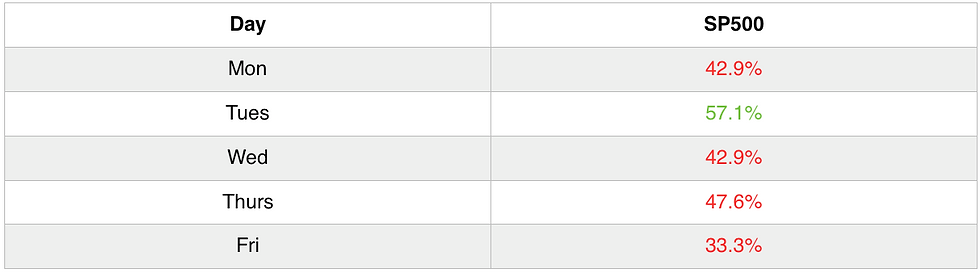

Friday is the most bearish day of the week.

*I didn't use the seasonal model these few weeks as I've encountered some problems with it because I found its statistics do not match with my mentor's. Will use it again until issues are solved.

Key Economic Dates:

Key Earnings Release:

Mon BMO: TSN

Tues BMO: JEC, KORS, RL

Tues AMC: PCLN, DIS

Wed AMC: FOXA

Thurs BMO: KSS, M

Thurs AMC: JWN, NVDA, SNAP

Fri BMO: JCP

Thoughts:

There'll be a couple of retailers going to announce their earnings and the Retail Sector is expected to have some wild swings, which I think would not be good. For such, I'd expect the Discretionary Sector to have another negative week. Given the bearish statistics by the Almanac, it wouldn't be a surprise if it's a red week ahead.

Comments