What the U.S. Earnings tell us so far?

- campazine

- Aug 7, 2017

- 2 min read

Bulls' hope on the market: Live long and prosper.

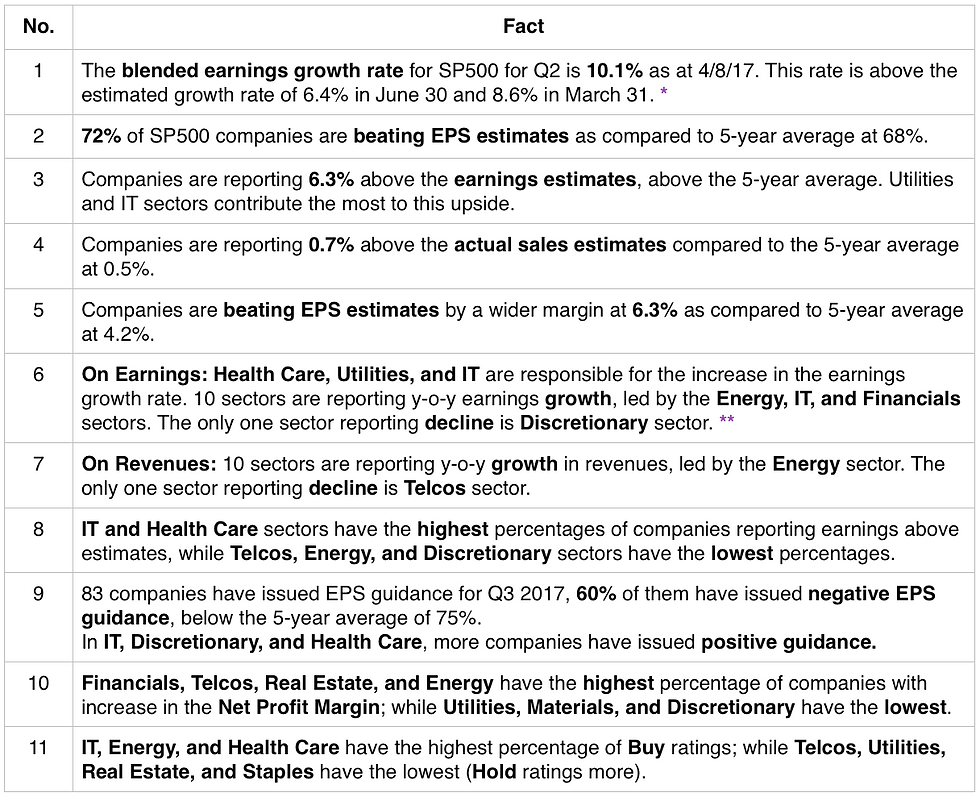

84% of the companies in SP500 have reported their earnings for Q2 2017 to date, and in case you're wondering, they are generally positive. During the earnings calls for Q2, it can be seen that businesses are waiting for Trump administration's pro-business policies to be really executed, and they are especially looking forward for the tax and deregulation policies. You might be a Trump hater, but it's hard to deny that many businesses are actually becoming confident of the future of their businesses again because of a president that constantly seeks for ways to boost their growth. Below are the summarised facts extracted from FactSet Research data:

* This growth rate is the 2nd highest y-o-y earnings growth since Q4 2011, and the first time it has 2 consecutive quarters of double-digit y-o-y earnings growth since Q3 & Q4 2011.

** Energy is reporting the highest y-o-y earnings growth of all sectors at 330.2%, mainly due to unusually low earnings in the year-ago quarter.

IT ranked 2nd at 14.3%. Semiconductor, Software, IT Services & Technology, Hardware, Storage & Peripherals report double-digit earnings growth. Semiconductor is the largest contributor.

Financials ranked 3rd at 11%. Insurance, Capital Markets, and Banks are reporting growth with Insurance industry leads the growth.

Discretionary is the only sector reporting decline in earnings at -0.9%. 7 of 12 industries in this sector reported a decline, led by Leisure Products AND Internet & Direct Marketing Retail. Amazon is the largest contributor to the earnings decline.

It's obvious that the Health Care and IT are the stars amongst the 11 sectors, while Telcos and Discretionary are struggling. Is US economy heading for trouble? Looks like it's not. The earnings result are actually fantastic. The reason we need to examine the corporate earnings is mainly because signs of slowing down would signal crash ahead.

If you zoom in the graph above here, you'd notice that there's almost always a declining profit before every major recessions. Thus, as corporate profit looks healthy for now, I can conclude that market crash into recession is not in sight. But still, that does not mean a correction is not due.

Disclaimer: All data on this post is derived from FactSet Insight, you can get the full report here.

Comments