Weekly Market Update (14/8/17 - 18/8/17)

- campazine

- Aug 21, 2017

- 4 min read

Bear is coming out for a party on Thursday.

SP500: -0.7%

Wall Street had another disappointing week, its second in a row, as investors continued to drag the major U.S. indices from their all-time highs. The Dow, the S&P 500, and the Nasdaq finished with losses of 0.8%, 0.7%, and 0.6%, respectively, while the small-cap Russell 2000 underperformed (-1.2%), dropping to its flat line for the year.

Five sectors settled the week in the green--utilities (+1.3%), materials (+0.4%), real estate (+0.2%), consumer staples (+0.1%), and technology (unch)--while six groups finished in the red--energy (-2.7%), telecom services (-1.8%), consumer discretionary (-1.8%), industrials (-1.1%), health care (-0.8%), and financials (-0.5%).

The week's most notable headlines in chronological order:

Monday--S&P 500 +1.0%, Nasdaq +1.3%, Dow +0.6%

Investors breathed a sigh of relief after a quiet weekend in regards to North Korea

Tuesday--S&P 500 -0.1%, Nasdaq -0.1%, Dow unch

North Korea decided against executing last week's threat to launch missiles towards the U.S. territory of Guam

July Retail Sales came in hotter than expected (+0.6% actual vs +0.3% Briefing.com consensus)

Wednesday--S&P 500 +0.1%, Nasdaq +0.2%, Dow +0.1%

President Trump ended his Manufacturing Council and Strategy & Policy Forum following the departure of several CEOs

The FOMC minutes from the July meeting showed concerns about softer than expected inflation readings

Thursday--S&P 500 -1.5%, Nasdaq -1.9%, Dow -1.2%

Rumors that NEC Director Gary Cohn plans to resign circulated; the White House said the rumors are false

Terrorist attacks in Spain killed 14 and left more than 100 injured

Friday--S&P 500 -0.2%, Nasdaq -0.1%, Dow -0.4%

President Trump fired White House Chief Strategist Steve Bannon

The SPDR S&P Retail ETF (XRT) settled at its worst level since February 2016 following this week's batch of earnings

Thursday's session was perhaps the most notable of the week as the S&P 500 registered its second-worst performance of the year. The major indices opened Thursday's session with modest losses, but moved deeper into negative territory following a rumor that President Trump's chief economic advisor Gary Cohn plans to resign from his position following the president's controversial comments regarding last weekend's events in Charlottesville, VA. The White House later declared that the rumor was "100% false", but it did little to reverse the market's downward trend.

True or not, the rumor didn't do much to dispel the notion that working with the president could be a political liability, especially considering that it came on the heels of Mr. Trump's Wednesday decision to disband his Manufacturing Council and Strategy & Policy Forum in response to several CEOs leaving the two groups. The chief executives cited Mr. Trump's controversial Charlottesville comments as the reason for their departures. If Republicans in Congress start distancing themselves from Mr. Trump, it will be that much harder for him to push through his pro-growth agenda.

However, those concerns eased a bit on Friday after President Trump fired White House Chief Strategist Steve Bannon, a decision that was well received by the market. Mr. Bannon was the chief executive of Mr. Trump's presidential campaign and has been described as perhaps the most polarizing figure within President Trump’s inner circle. Therefore, in the absence of Mr. Bannon, the thinking is that the president might dial back his rhetoric a bit, making it easier for the White House to work with Congress in passing the president's pro-growth agenda.

Following this week's events, the fed funds futures market now points to the March 2018 FOMC meeting as the most likely time for the next rate-hike announcement with an implied probability of 51.5%. Last week, the market expected the next rate hike to occur in June 2018 with an implied probability of 57.5%.

Nasdaq Composite +15.5% YTD

Dow Jones Industrial Average +9.7% YTD

S&P 500 +8.3% YTD

Russell 2000 +0.1% YTD

(extracted from www.briefing.com)

Yield Performance

There's little change in the yield curve from previous week's, except that it's becoming slightly inverted as the 2-year yield has gone up. Inverted yield curve typically means economy is weakening and signals crash in 6 months to 1 year.

Sector Performance

The defensive sectors are having a good week, utilities sector is bullish, continues its stable performance since few weeks ago, Materials and Real Estate are taking a breath from their weak performance.

Commodities Performance

Crude oil closed lower.

Gold closed lower.

Silver closed lower.

Copper closed higher.

Week 34 BMO:

Info: Stock Trader's Almanac 2017.

Week after August Expiration mixed, Dow down 6 of last 11.

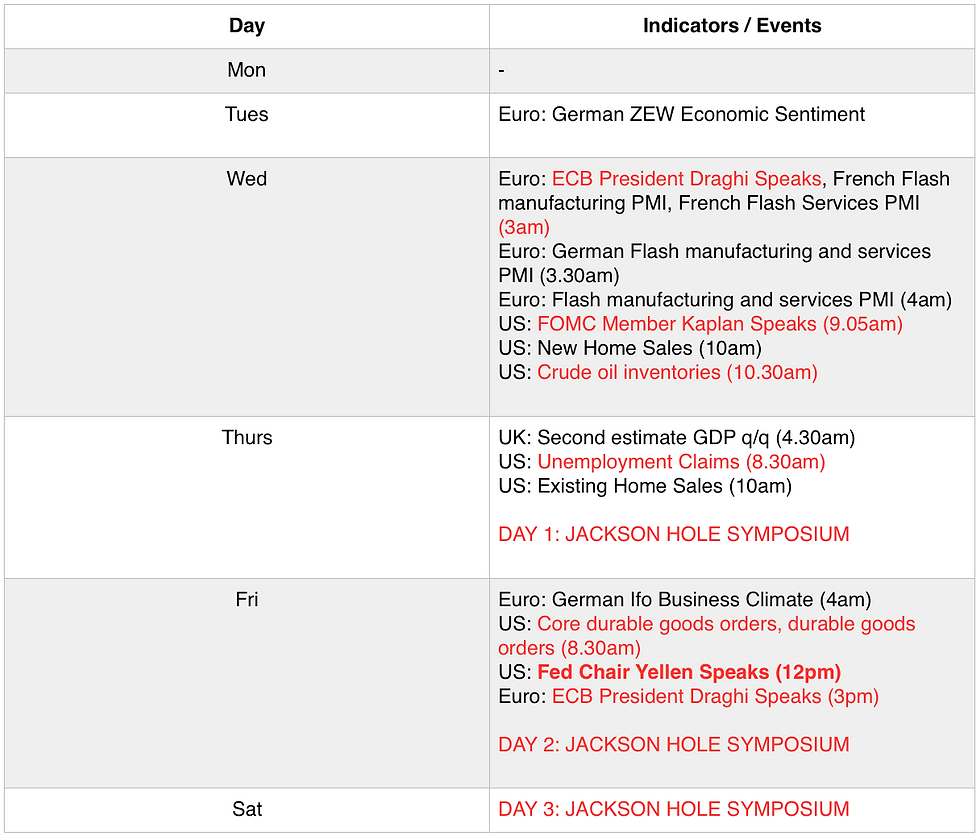

Key Economic Dates:

Thoughts:

The 'Buy the Dip' mentality did creep in on Monday with 1% gain but it's wiped out on Thursday following terrorist attack in Spain and political instability within the US itself. As expected, the retail sector crumbled, and as there're still a couple more that are going to report earnings in the coming week, don't expect it to be rebounding anytime soon. For SPY, I'd expect it's going to be another volatile week as there're quite a number of important economic indicators and events happening in the coming week. As a side note, it's important to know that Russell 2000 is closing at an important support while the MA50 has crossed below MA20 on last Wednesday. As it's one of the important indicator of the US economy, it's best to monitor Russell 2000 for any signals.

Comments